Modernizing Digital Banking with AWS and CloudOps at Leading Financial Institution

Overview

The bank is a leading financial institution that must provide secure and reliable digital banking services. Mobile and online usage keep growing. Regulation keeps getting tighter. The bank wanted a cloud operations model that gives clear visibility into digital services, strong guardrails, and fast incident response.

B8 ICT Solutions designed and implemented this model on AWS. The goal is simple. Keep payments and wallet journeys healthy. Reduce operational risk. Make change safe and auditable. Give the bank a platform that can grow without losing control.

Key Challenges

The payments and wallet platform faced several operational challenges:

- The team did not have a single place to see the health of critical journeys such as login, wallet top-up, transfer, and bill payment. Signals were spread across many tools, making it hard to know if a problem was in the app, the platform, or an external integration.

- Incidents depended on manual investigation and ad-hoc recovery steps. Time to detect and time to resolve priority incidents were longer than acceptable for a regulated digital channel.

- Patching and configuration of servers, containers, and databases were not driven by one standard process. Proving compliance during audits required extra effort and manual evidence collection.

- There was no clear multi-account story for governance. Policies such as region limits, encryption, and access control were handled at the account or team level rather than through central guardrails.

- Cloud spend was not tied cleanly to products and environments. Leaders wanted better visibility into which services drove cost so they could plan budgets and make tradeoffs with confidence.

Key Results

After the cloud operations model was in place the bank and B8 ICT Solutions started to track a simple set of metrics that describe how well operations are working. Examples include

- Time to detect and time to resolve for priority one and priority two incidents on the wallet and payments journeys

- Availability for key digital flows such as sign in, wallet top up, and payment during both normal days and peak events

- Patch coverage for production and non production fleets within an agreed time window

- Counts of open high and medium findings from AWS Config and AWS Security Hub and how quickly they are addressed

- Monthly cloud spend by product and environment and the gap between forecast and actual

The bank now uses these metrics in steering meetings, in incident reviews, and in quarterly planning. They show a clear improvement compared with the period before this model. The exact values can be shared with AWS reviewers as supporting evidence.

Solution

To meet these needs, B8 ICT Solutions implemented a CloudOps architecture on AWS:

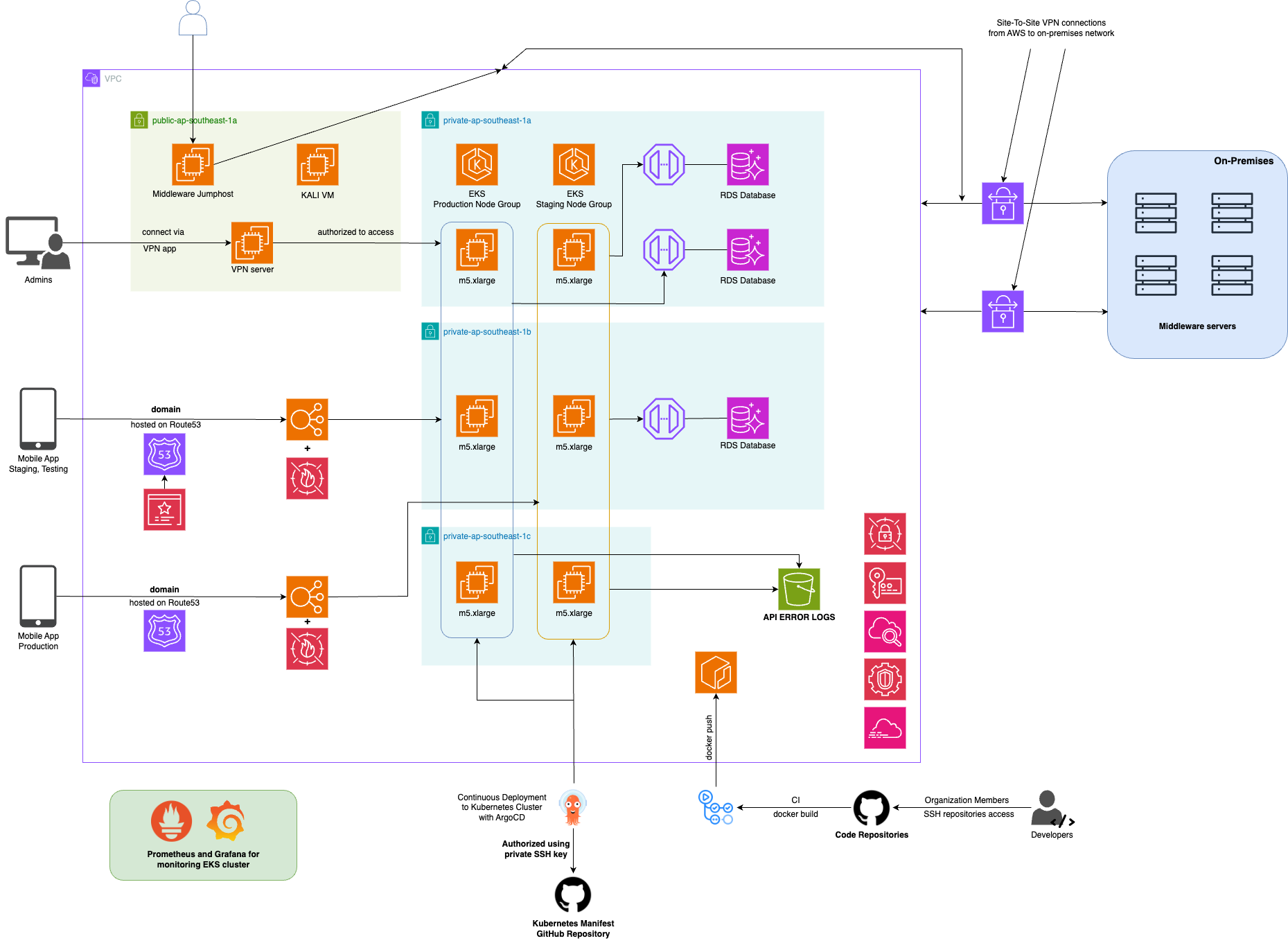

The bank wanted the digital wallet and payments platform to feel calm and predictable to run. B8 ICT Solutions set up an operating model on AWS that does this in a simple way. The workloads run on Amazon EKS and Amazon EC2. Data sits in Amazon Aurora and Amazon RDS. Traffic comes through Amazon Route 53. Images and logs go to Amazon S3. GitHub Actions and Argo CD handle application delivery so every change has a clear path into and out of production.

The first focus was to make service health easy to see. Application code and platform components send metrics and logs into Amazon CloudWatch. Where it helps, Prometheus and Grafana add more detailed views for engineers. Dashboards show the key journeys such as sign in and wallet top up and payment. They show success rate and latency and error rate in one place so teams can agree on what good looks like. CloudWatch alarms watch those signals and send alerts through Amazon SNS into the on call channel. Short synthetic checks hit public endpoints so the team knows early when a customer path is at risk.

The next focus was day to day operations. AWS Systems Manager Patch Manager keeps operating systems up to date. Instances and nodes carry tags for environment and role so patch plans are simple to define. Maintenance windows match the bank change calendar so teams know when updates will happen. Systems Manager Automation and Run Command store routine actions such as restarting services and draining nodes and rolling back a release. When an incident happens, staff follow a short runbook. They open the right dashboard, run a small number of checks, use the prepared automation steps, and keep a clear record of what they did. GitHub Actions and Argo CD give a traceable history of deployments so it is easy to roll forward or back in a controlled way.

Governance and compliance are built into the platform rather than added later. AWS Organizations separates production, non production, shared services, and security accounts. Service control policies set simple rules. Teams use only approved regions. Storage and databases use encryption. Certain sensitive actions require central roles. AWS Config records how resources are set up and checks them against rules for topics such as public access on storage, open security groups, and required tags. Findings from AWS Config, Amazon GuardDuty, and Amazon Inspector flow into AWS Security Hub where the security and platform teams review them on a regular cycle. AWS CloudTrail sends a full history of API activity into a central logging account and into Amazon S3 so investigations and audits can see who did what and when.

Cost is treated as part of operations and not just a finance concern. The bank and B8 ICT Solutions agreed on a simple tagging standard for application and environment and owner and cost center. Pipelines apply these tags from the start. AWS Budgets watches spend for each account and for important product slices and sends alerts when usage approaches agreed limits. AWS Cost Explorer and Cost Categories provide a clear view of which applications and environments drive cost. The teams review this view in a regular forum and use it to decide where to right size resources, where to switch to different instance families, and how to plan for peak events such as salary days and campaigns.

With these pieces working together, the bank has a platform where engineers and operators can see what is happening, act in a calm and repeatable way, and prove to auditors and leaders that the service is under control even as usage grows.

Key technologies in this digital banking application include -

- Amazon CloudWatch : Unified metrics, logs, dashboards, and alarms to track service health and uphold SLOs.

- AWS CloudTrail : Tamper-evident record of API activity across regions for change tracking and investigations.

- AWS Config : Ongoing configuration checks and drift detection against defined policies.

- AWS Systems Manager (SSM) : Patch automation, runbooks, remote commands, and parameter management for fleet operations.

- AWS Security Hub : Central view of security posture mapped to CIS and AWS best practices.

- Amazon GuardDuty : Always-on threat detection from account, network, and workload signals.

- Amazon Inspector : Automated vulnerability assessments for EC2 and container images.

- AWS Backup : Policy-driven, centralized backups and restores to meet compliance.

- Amazon EventBridge : Event routing to kick off notifications, workflows, and auto-remediation.

- AWS Lambda : Serverless functions for alert handling and remediation steps.

- AWS Budgets : Cost thresholds with alerts to control monthly spend and variance.

- AWS Cost Explorer & Cost Categories : Analyze spend and allocate costs by app or environment.

- AWS IAM Access Analyzer : Reviews sharing policies to prevent unintended access.

- AWS Organizations & SCPs : Multi-account governance with preventive guardrails at the org level.

Benefits

With this cloud operations model the bank has a payments and wallet platform that is stable, auditable, and ready to grow.

Financial

The bank can see where cloud spend comes from and which services drive cost. Budgets and cost reports give leaders a clear picture at month end. This supports better planning and more confident investment decisions.

Operational

Incidents follow a calm and repeatable process. On call staff have the right information and tools. Changes move through pipelines that are traceable and reversible. Governance and security checks run in the background, not as a last minute scramble.

Performance and reliability

Teams watch customer journeys on shared dashboards. They see latency, error rate, and availability in real time. Capacity planning and autoscaling use real traffic data, so peak events are handled with less risk to the customer experience.

Conclusion

By adopting a cloud operations approach on AWS the bank and B8 ICT Solutions built a secure, compliant, and highly available digital payments platform on Amazon EKS. The model brings together observability, disciplined operations, strong governance, and cost awareness. It gives the bank a clear view of service health, reduces operational risk, and supports rapid but controlled change across its digital channels.